Feie Calculator Things To Know Before You Buy

Table of ContentsFacts About Feie Calculator UncoveredThe Ultimate Guide To Feie CalculatorWhat Does Feie Calculator Do?The Basic Principles Of Feie Calculator The 20-Second Trick For Feie Calculator

He marketed his United state home to establish his intent to live abroad completely and used for a Mexican residency visa with his partner to assist meet the Bona Fide Residency Test. In addition, Neil protected a long-term home lease in Mexico, with strategies to ultimately buy a home. "I presently have a six-month lease on a residence in Mexico that I can prolong another 6 months, with the purpose to buy a home down there." Nevertheless, Neil aims out that acquiring property abroad can be challenging without very first experiencing the area."It's something that people need to be truly attentive concerning," he states, and recommends expats to be careful of typical mistakes, such as overstaying in the United state

Neil is careful to cautious to Anxiety tax united state that "I'm not conducting any performing any type of Organization. The U.S. is one of the couple of countries that taxes its residents regardless of where they live, suggesting that also if an expat has no revenue from United state

tax return. "The Foreign Tax Credit rating permits people working in high-tax countries like the UK to counter their United state tax obligation liability by the quantity they've already paid in taxes abroad," says Lewis.

Facts About Feie Calculator Revealed

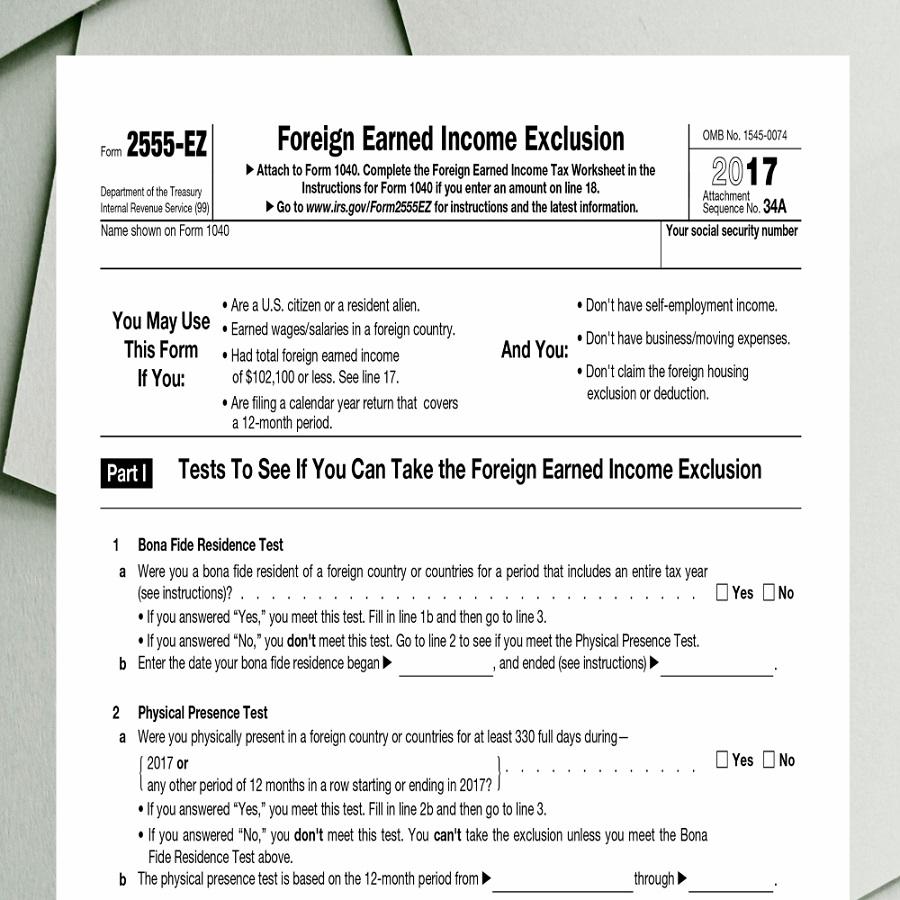

Below are some of one of the most often asked questions concerning the FEIE and various other exemptions The International Earned Revenue Exemption (FEIE) permits U.S. taxpayers to omit approximately $130,000 of foreign-earned revenue from government income tax obligation, reducing their U.S. tax obligation obligation. To get FEIE, you must satisfy either the Physical Existence Examination (330 days abroad) or the Bona Fide Residence Test (verify your primary residence in a foreign nation for an entire tax obligation year).

The Physical Presence Examination also calls for United state taxpayers to have both an international income and a foreign tax obligation home.

The Ultimate Guide To Feie Calculator

An income tax treaty between the united state and an additional nation can help prevent double taxation. While the Foreign Earned Earnings Exclusion minimizes taxable income, a treaty may supply extra benefits for qualified taxpayers abroad. FBAR (Foreign Bank Account Report) is a called for declare U.S. residents with over $10,000 in foreign monetary accounts.

Qualification for FEIE depends on conference specific residency or physical presence examinations. is a tax obligation advisor on the Harness system and the founder of Chessis Tax. He belongs to the National Association of Enrolled Agents, the Texas Society of Enrolled Brokers, and the Texas Culture of CPAs. He brings over a years of experience helping Big 4 companies, suggesting migrants and high-net-worth individuals.

Neil Johnson, CPA, is a tax consultant on the Harness system and the owner of The Tax obligation Man. He has over thirty years of experience and currently concentrates on CFO solutions, equity compensation, copyright tax, marijuana taxation and separation associated tax/financial preparation matters. He is a deportee based in Mexico - https://businesslistingplus.com/profile/feie-calculator/.

The international earned earnings exemptions, occasionally described as the Sec. 911 exemptions, leave out tax on earnings made from working abroad. The exemptions comprise 2 parts - an income exclusion and a housing exemption. The adhering to FAQs discuss the advantage of the exemptions including when both spouses are expats in a basic manner.

The 9-Second Trick For Feie Calculator

The tax advantage excludes the earnings from tax at bottom tax prices. Formerly, the exemptions "came off the top" reducing revenue topic to tax at the top tax rates.

These exclusions do not excuse the earnings from US taxation yet just provide image source a tax obligation reduction. Keep in mind that a bachelor working abroad for all of 2025 that made regarding $145,000 without any other revenue will certainly have gross income decreased to no - successfully the exact same answer as being "tax totally free." The exemptions are calculated every day.